Four Ways to Improve your Business Budgeting

The following is an extract from Accounting and Finance for Managers.

Not all critics of budgeting suggest that the process should be abandoned. There has been strong interest in recent years, both among academics and practitioners, in improving budgets to make them more useful for the current business environment. Key elements which have been identified for improving the process are better communication and collaboration. In particular, rather than budget negotiation being a process of arguing for and justifying budget allocations, it should be a process of sharing and exploring views of the future operating environment.

Although there is an advocacy for going ‘beyond budgeting’, the mainstream of current thinking on budgeting focuses on improving the budgeting process. This includes better integration between strategic planning and budgeting, better feeding of business intelligence into the budgeting process, greater inclusion and teamwork and less bureaucracy. These measures will reduce the cost of budgeting and improve its effectiveness.

Four developments in budgeting that are being more widely adopted are rolling budgets, zero-based budgets, activity-based budgets and kaizen budgets. We will therefore look at these developments in a little more detail.

Rolling budgets

A rolling budget is sometimes also called a continuous budget. This approach involves always having a 12-month ongoing budget. Rather than set a budget for a fixed 12-month period, the organization at the end of every month will add another month to their budget so that there is always a 12-month budget in place. The advantage of this approach is that managers’ attention is continuously placed on what will be happening over the next 12 months, rather than the remaining months of a fixed-period budget. The process often also involves revising the 11-month budget that was already set.

The rolling budget is extremely useful for organizations that have uncertain levels of activities and need to respond by adjusting their capacity and operating levels. For example, a building contractor may operate a rolling budget in order to ensure that labour and equipment are in place during busy periods but that they are not idle when work is not available. This approach enables both greater flexibility and tighter control through its frequent revision and updating. However, the process can be resource-intensive and time-consuming as the organization is effectively continuously producing a budget. It also requires a more flexible management approach, as managers may find themselves working to constantly changing budgets. If not implemented and managed well, this can lead to confusion and frustration.

Zero-based budgeting

Zero-based budgeting (ZBB) involves building the budget without reference to what happened in the past. The idea behind ZBB is to avoid some of the pitfalls of incremental budgeting. These include continuing existing inefficiencies and failure to re-evaluate how things are done. The ZBB approach starts each budget afresh, rather than basing the budget on historical data from previous periods. Managers must make a case for resources and their budget will be zero unless they can justify the budget allocation they require. The advantage of this approach is that every activity is questioned and has to be justified in terms of costs involved and benefits accrued. Resources are therefore allocated according to results and needs and wasteful budget ‘slack’ is eliminated. The approach also encourages managers to question the way resources are being allocated and to look for alternatives.

Many organizations and particularly the health sector have seen substantial benefits from using ZBB. It can result in an organization radically changing its cost structures, cutting substantial amounts from overhead and support costs whilst increasing efficiency and competitiveness. It encourages managers to be forward thinking in terms of identifying what activities and resources will be needed to compete in future market conditions. Because this is done on a ground-up basis rather than an incremental approach of targeting areas where costs can be cut, managers must justify what to keep rather than what to remove. This can produce far more substantial changes in cost and performance.

The ZBB process is therefore particularly useful for organizations which have recently experienced substantial structural change such as an acquisition or a merger which may have left a legacy of unnecessary overhead costs. Also, changes in the competitive environment may create increasing pressures on costs such that an organization needs to re-examine the way it delivers its goods or services.

The ZBB process is both complex and time-consuming. This can also make it costly such that ultimately there has to be a payoff in terms of the costs and benefits. The process can also create internal conflict within organizations as managers are forced to compete annually for budget allocation. ZBB has also been criticized for focusing on short-term benefits to the detriment of longer-term strategic development.

Although ZBB is a good idea in principle, many organizations have found that in practice it is best combined with incremental budgeting. It can be useful to prepare a zero-based budget periodically; to do so continually year after year offers little benefit, particularly if there are no major changes to the way the organization is operating. Some organizations have therefore incorporated ZBB by using it only every few years or when a major change occurs within the organization. Between the ZBB sessions they revert to an incremental approach.

The ZBB approach became very popular in the 1970s, having originally been developed at Texas Instruments in Dallas (Pyhrr, 1973). However, due largely to the practical problems outlined above, many companies implemented the approach in some form and found that it did not work for them. It has fallen out of popularity in recent years. It is, however, still used in many areas of the public sector.

Activity-based budgeting

One approach to improving the budgeting process which has gained popularity over the past decade is activity-based budgeting (ABB).

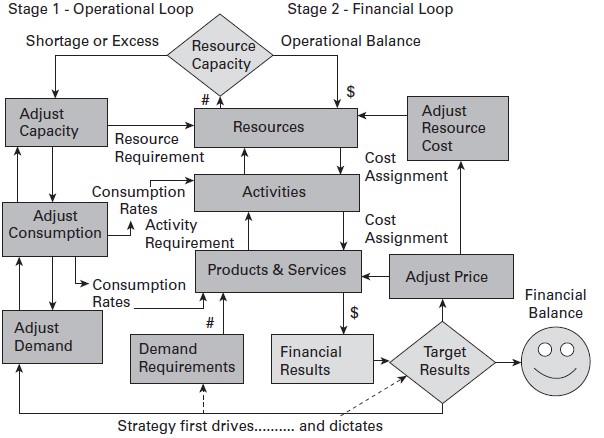

The most comprehensive model of ABB has been developed by the Consortium of Advanced Management, International (CAM-I), published in a book entitled The Closed Loop in 2004. This model is illustrated in Figure 5.5.

Figure 5.5 Activity-based budgeting

Figure 5.5 Activity-based budgeting

ABB focuses on the activities of an organization rather than its departments or products. The approach is based upon the concept that costs are driven by activities. It focuses on how activities add value within the organization and expresses budgets in terms of activity costs. This is in contrast to the traditional approach to budgeting which involves focusing on the input of resources and identifying those in terms of functional areas.

The advantage of ABB is that the cost of activities within the organization are clearly highlighted in a way that does not happen in the traditional budgeting approach. These activities can then be linked back to the mission and strategic goals of the organization.

ABB has developed many of the ideas of ZBB and can be linked with activity-based costing as part of a more general activity-based management approach.

This approach has been popular with many public-sector organizations such as law enforcement and health care, as it enables such organizations to identify the costs of the individual services they provide.

Kaizen budgeting

Kaizen is a Japanese term that refers to the philosophy of continuous improvement. We will look at this concept again in more detail in Chapter 8 when we examine pricing and costing strategies. The concept of kaizen focuses on gradual and continuous improvement over time, rather than the large changes and fast improvements sought through approaches such as zero-based budgeting. The focus of a kaizen approach is on finding small areas that can be improved. By making continuous small improvements in several areas over a long period of time, large cost savings can be achieved.

Kaizen budgeting can require a great deal of management time, resources and planning, as this approach involves considering all parts of the business, pinpointing possible improvement and implementing them. Building kaizen improvements into budgets can be difficult in practice, as it is often not possible to predict the levels of costs savings that will be achieved. For this reason, many companies budget for cost reductions based upon historic kaizen savings, or aspirational savings based upon specific kaizen projects.

One of the benefits of kaizen budgeting is that it can be used to measure the performance of managers in terms of the cost savings that they achieve over time. It is therefore often an approach that is linked to incentive schemes. However, a problem with kaizen budgeting is that cost reductions are difficult to sustain in the longer term. It is easier to find cost savings in the first few years, after which the opportunity for further savings will decrease. If kaizen cost-saving targets are set too high this will result in extensive unfavourable budget variances and under-performance, which can be demotivating for managers and counter-productive.